Investing is a fantastic way to grow your wealth and secure your financial future. However, it’s crucial to approach it with caution and make sure the timing is right for you. Rushing into investments without careful consideration can lead to unfavorable outcomes and financial setbacks. In this article, we will explore the dangers of investing and provide valuable insights to help you navigate this complex landscape.

Getting Your Finances in Order

Before diving into the world of investments, it’s essential to focus on getting your finances in order. This step ensures that you won’t be forced to sell your investments prematurely, potentially incurring losses. Take the time to evaluate your current financial situation, including your income, expenses, and outstanding debts.

Consider paying off high-interest debts, such as credit card balances or personal loans, before allocating funds to investments. By reducing your debt burden, you’ll free up more disposable income to invest and minimize the risk of financial strain. Additionally, building up an emergency fund is crucial to provide a safety net for unexpected expenses, so you won’t have to tap into your investments prematurely.

Investing in Yourself

In today’s environment, it seems like everyone is offering advice on how to get rich quickly through investments. While it’s tempting to chase the latest stock or investment trend, sometimes the best investment you can make is in yourself. Take the time to assess your current situation and identify areas where personal growth and improvement are needed.

Investing in yourself may involve acquiring new skills, furthering your education, or improving your health and well-being. By focusing on personal growth, you’ll enhance your earning potential and overall financial stability. This, in turn, will put you in a better position to make informed investment decisions in the future.

Considerations for Better Investment Decisions

Once your finances are in order and you’ve invested in yourself, you’ll be better equipped to make wise investment choices. Here are a few considerations to keep in mind:

- Diversification: Spreading your investments across different asset classes can help mitigate risk. By diversifying your portfolio, you reduce the impact of any single investment’s poor performance.

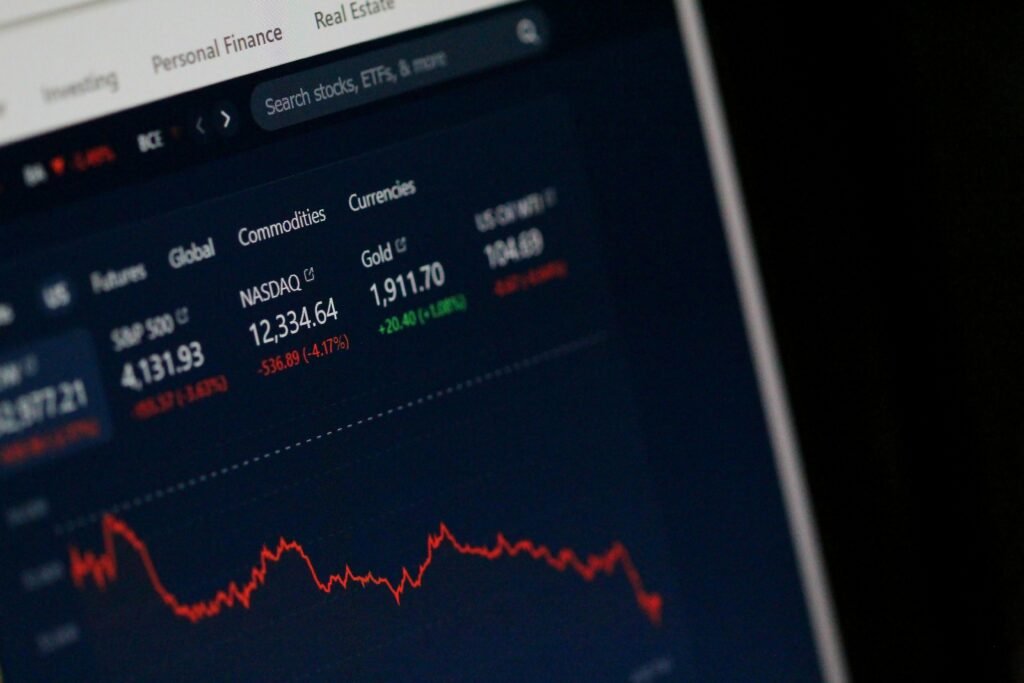

- Long-term perspective: Investing should be viewed as a long-term strategy. While short-term fluctuations are inevitable, focusing on the bigger picture can help you ride out market volatility and potentially earn higher returns.

- Research and due diligence: Before investing in any particular asset, thoroughly research and understand its potential risks and rewards. Seek advice from financial professionals if needed and stay informed about market trends.

- Regular review and adjustments: Keep track of your investments and periodically review their performance. Make adjustments as necessary to align with your financial goals and risk tolerance.

Remember, investing is a journey that requires patience, discipline, and careful planning. It’s essential to approach it with a long-term perspective, considering your financial situation and personal growth. By taking these steps, you’ll be better prepared to navigate the potential dangers of investing and increase your chances of achieving financial success.

In conclusion, while investing can be a rewarding endeavor, it’s crucial to proceed with caution. Prioritize getting your finances in order, invest in yourself, and approach investment decisions with careful consideration. By doing so, you’ll mitigate the dangers associated with investing and set yourself up for long-term financial growth and stability.